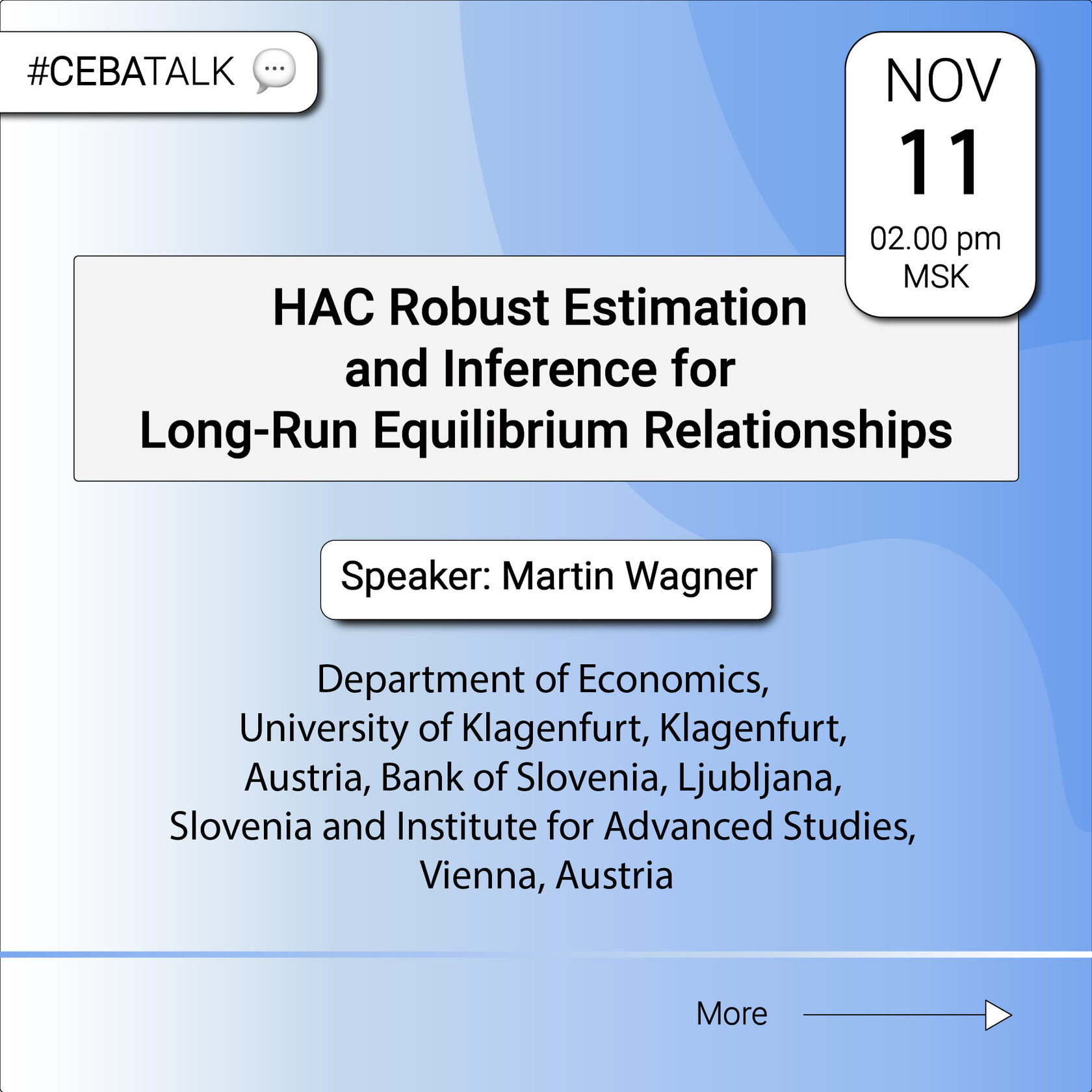

Speaker: Martin Wagner (Department of Economics, University of Klagenfurt, Klagenfurt, Austria, Bank of Slovenia, Ljubljana, Slovenia and Institute for Advanced Studies, Vienna, Austria)

Title: HAC Robust Estimation and Inference for Long-Run Equilibrium Relationships

Field of study

"Econometrics, Quantitative Economics, Environmental Economics, Transition Economics."

What problem is your research intended to solve?

"Performing parameter estiimation and inference for long-run equilibrium relationships properly in the context of changing environments."

What did your research find?

"Because it provides results for doing things properly."

Abstract: We extend cointegration analysis to a situation where the first differences of the analyzed processes are so-called locally stationary processes (see, e.g., Dahlhaus, 1997) rather than stationary processes. This allows us to model long-run relationships between time series whilst allowing for more or less turbulent or persistent periods in the analysis. As is common in the cointegrating regression literature, we allow for regressor endogeneity and error serial correlation, now both time-varying because of our locally-stationary setup. The paper starts by developing the required functional central limit results for this setting which then allow showing that: First, the OLS estimator is consistent but its limiting distribution is contaminated by second-order bias terms, which differ, of course, from the bias terms arising in the standard context. Second, a localized version of the fully modified OLS estimator, originally considered in Phillips and Hansen (1990) for a standard cointegration setting, leads to a zero mean Gaussian mixture limiting distribution. An important difference to the standard cointegration setting is that fully modified based inference requires something like a HAC-type correction. The theoretical analysis is complemented by a simulation study as well as an empirical illustration with the forward rate unbiasedness hypothesis.

More information, a link to the research and the upcoming seminar here.

We are looking forward to seeing you!