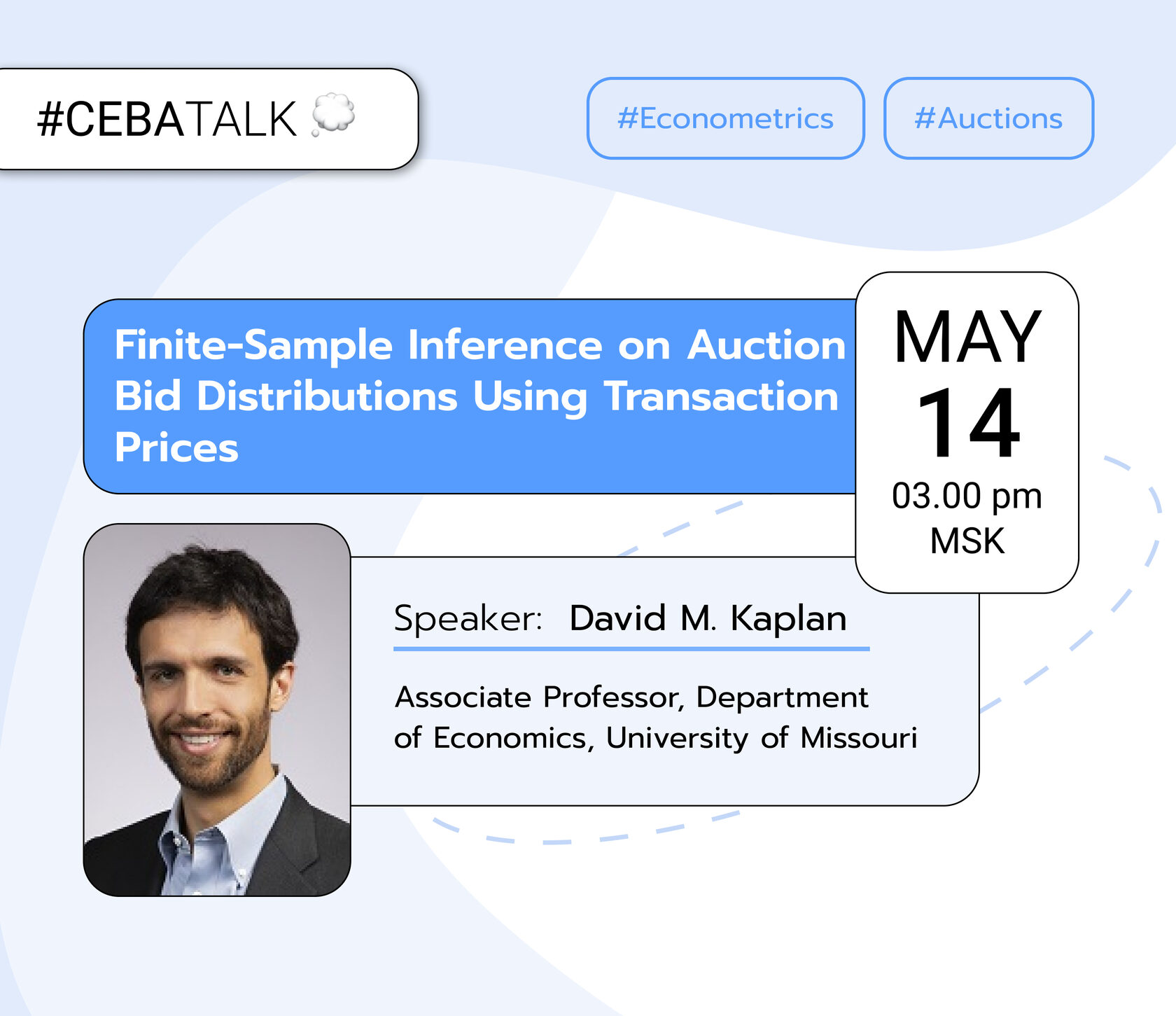

Time: 14th May (Tuesday) 15.00 Moscow time

Speaker: David M. Kaplan (Associate Professor, Department of Economics, University of Missouri)

Title: Finite-Sample Inference on Auction Bid Distributions Using Transaction Prices

Field of study

"Econometrics and auctions"

What problem is your research intended to solve?

"When we only observe the winning bid or transaction price of an auction, how can we precisely quantify our uncertainty about the full distribution of bids? Can we do this even if the number of bidders differs across auctions? What if there are unobserved forces that affect bids and differ across auctions?"

What did your research find?

"We provide new methods that answer all our research questions, for several of the most common types of auction. Others can use our methods and code to quantify uncertainty and learn about the bid distribution given auction data that only includes the transaction price and number of bidders."

Abstract: We provide finite-sample, nonparametric, uniform confidence bands for the bid distribution’s quantile function in first-price, second-price, descending, and ascending auctions with symmetric independent private values, when only the transaction price (highest or second-highest bid) is observed. Even with a varying number of bidders, finite-sample coverage is exact. With a fixed number of bidders, we also derive uniform confidence bands robust to auction-level unobserved heterogeneity. This includes new bounds on the bid quantile function in terms of the transaction price quantile function. We also provide results on computation, median-unbiased quantile estimation, and pointwise quantile inference. Empirically, our new methodology is applied to timber auction data to examine heterogeneity across appraisal value and number of bidders, which helps assess the combination of symmetric independent private values and exogenous participation.

More information, a link to the research and the upcoming seminar here.

We are looking forward to seeing you!

Speaker: David M. Kaplan (Associate Professor, Department of Economics, University of Missouri)

Title: Finite-Sample Inference on Auction Bid Distributions Using Transaction Prices

Field of study

"Econometrics and auctions"

What problem is your research intended to solve?

"When we only observe the winning bid or transaction price of an auction, how can we precisely quantify our uncertainty about the full distribution of bids? Can we do this even if the number of bidders differs across auctions? What if there are unobserved forces that affect bids and differ across auctions?"

What did your research find?

"We provide new methods that answer all our research questions, for several of the most common types of auction. Others can use our methods and code to quantify uncertainty and learn about the bid distribution given auction data that only includes the transaction price and number of bidders."

Abstract: We provide finite-sample, nonparametric, uniform confidence bands for the bid distribution’s quantile function in first-price, second-price, descending, and ascending auctions with symmetric independent private values, when only the transaction price (highest or second-highest bid) is observed. Even with a varying number of bidders, finite-sample coverage is exact. With a fixed number of bidders, we also derive uniform confidence bands robust to auction-level unobserved heterogeneity. This includes new bounds on the bid quantile function in terms of the transaction price quantile function. We also provide results on computation, median-unbiased quantile estimation, and pointwise quantile inference. Empirically, our new methodology is applied to timber auction data to examine heterogeneity across appraisal value and number of bidders, which helps assess the combination of symmetric independent private values and exogenous participation.

More information, a link to the research and the upcoming seminar here.

We are looking forward to seeing you!